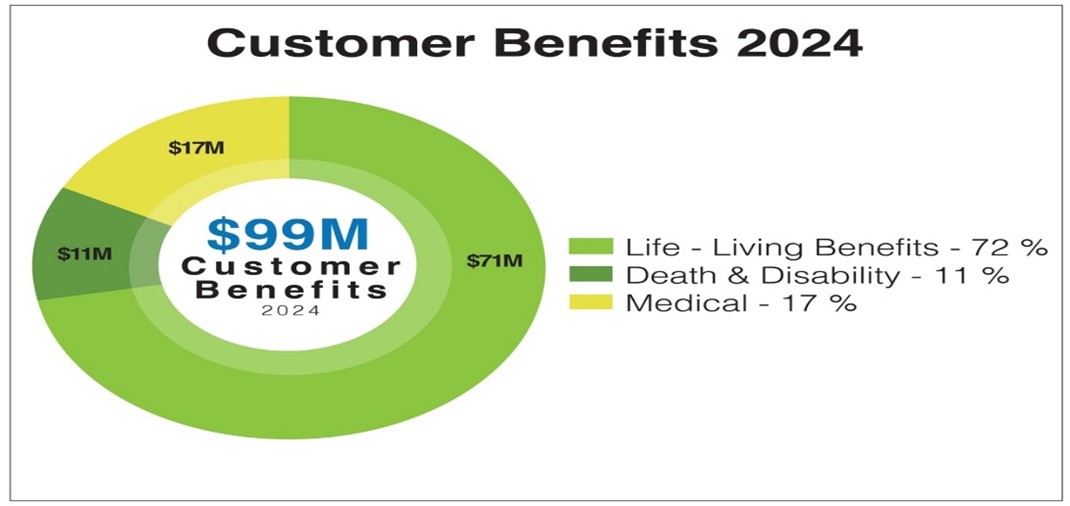

BSP Life, Fiji’s largest Life and Health insurer, paid $99 million in customer benefits and processed over 123,000 transactions throughout 2024.

This is the highest recorded in its 148-year history.

This averages $1.9 million and over 2000 transactions weekly. Managing Director Michael Nacola stated, “we are indebted to our customers for the trust they place in us. We service 73,000 policies covering over 100,000 lives and are grateful for the commitment customers make towards their policies, particularly when there are strains on family income. Life and Health insurance is extremely personal, and our team conscientiously aspires to pay benefits on-time to support customers in their time of need.”

The acceptance rate of 97% is in line with world best-practise. Mr Nacola added, “we again thank our customers for their patience when more information is required for us to process their benefits. We strive to provide world-class service and have streamlined processes and introduced digital platforms to enable customers to engage with us easily and for us to make payments efficiently.”

Of the total $99 million, $71 million comprised payouts for life insurance policies tied to products like Bula Elite, Bula Prime, Bula Scholar and Bula Delite. These payouts assisted customers with education, business-startups, purchase of assets, or well-deserved family holidays. A core benefit of BSP Life’s products is that they meet short to medium term financial plans, while also providing support for families in the event of untimely passing of the life insured, covering multiple needs with the same product.

Of the remaining $28 million, $17 million were for medical benefits including local and overseas hospitalisation, and $11 million were for death and disability claims.

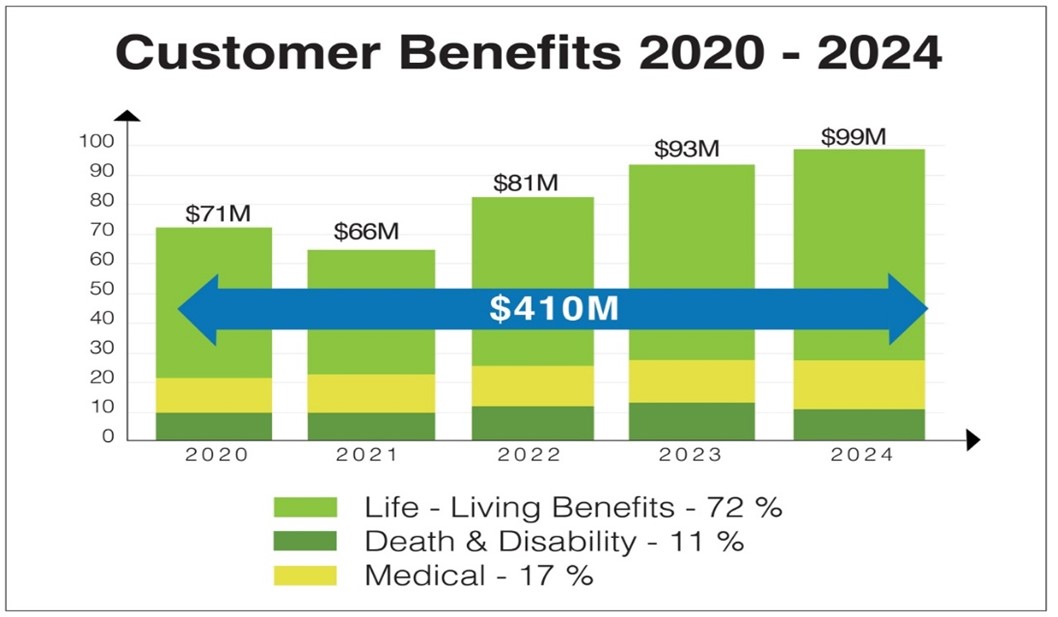

Over the past 5 years, BSP Life has paid $410 million with an escalating year on year trend. Mr Nacola concluded, “we’re delighted to see more Fijians investing with us, particularly young people joining the workforce.

Inculcating a savings habit at an early age pays dividends later in life and the increasing yearly payouts underscores this.

We will continue to advocate the importance of financial planning and intend to introduce new products to broaden our coverage across Fiji.”

– ENDS –