BSP Life today announced a record $80million in Benefit payouts for 2022. This equates to over $1.5million each week. Most payments were for Living Benefits from life insurance policies at $56 million. Death and Disability payments totalled $10 million while Health insurance payments totalled $14 million.

BSP Life’s Managing Director Mr Michael Nacola said, “Our purpose is to make a difference in people’s lives, and it gives us immense pride to see customers benefit from the investments they’ve made in their life and health insurance policies. We processed 95,000 payouts in 2022 helping many families navigate the financial challenges posed by the aftermath of the pandemic. We’ve been doing this for over 145 years demonstrating the financial and operational resilience of our brand. Our customers place their trust in us with the hard-earned premiums that they pay, and it is our duty to deliver on that trust by providing sustainable value for them.”

Around 70% of the payouts were for Living Benefits meaning customers received lump sums of cash on policy maturity, or during the policy term, depending on the products chosen. Maturity payouts were inclusive of bonuses accrued which are calculated on a compounding basis. The bonus rates on investment-linked products increased in 2020 and remained at the same level in 2021, despite the pandemic. Customers receiving these payouts were able to supplement retirement funds, set up a business, support their children’s tertiary education or take a well-deserved family holiday.

Health insurance customers received support for expensive overseas evacuations as well as GP visits, medication, diagnostics, and specialist treatments in local private hospitals. Evacuation claims for complex conditions like cancer exceeded $200,000 per case. The health insurance benefits supported all travel arrangements, medical costs, and accommodation with an accompanying person included.

The $10million in payouts for Death and Disability provided financial support to surviving family members and to policyholders who were disabled.

BSP Life had a 96% acceptance rate for all claims, with most payments processed on the date it was due. Complex claims for overseas medical treatment averaged 3-5 days if all requirements including medical reports were available. The introduction of digital platforms for customers to submit claims online enabled efficient claims servicing.

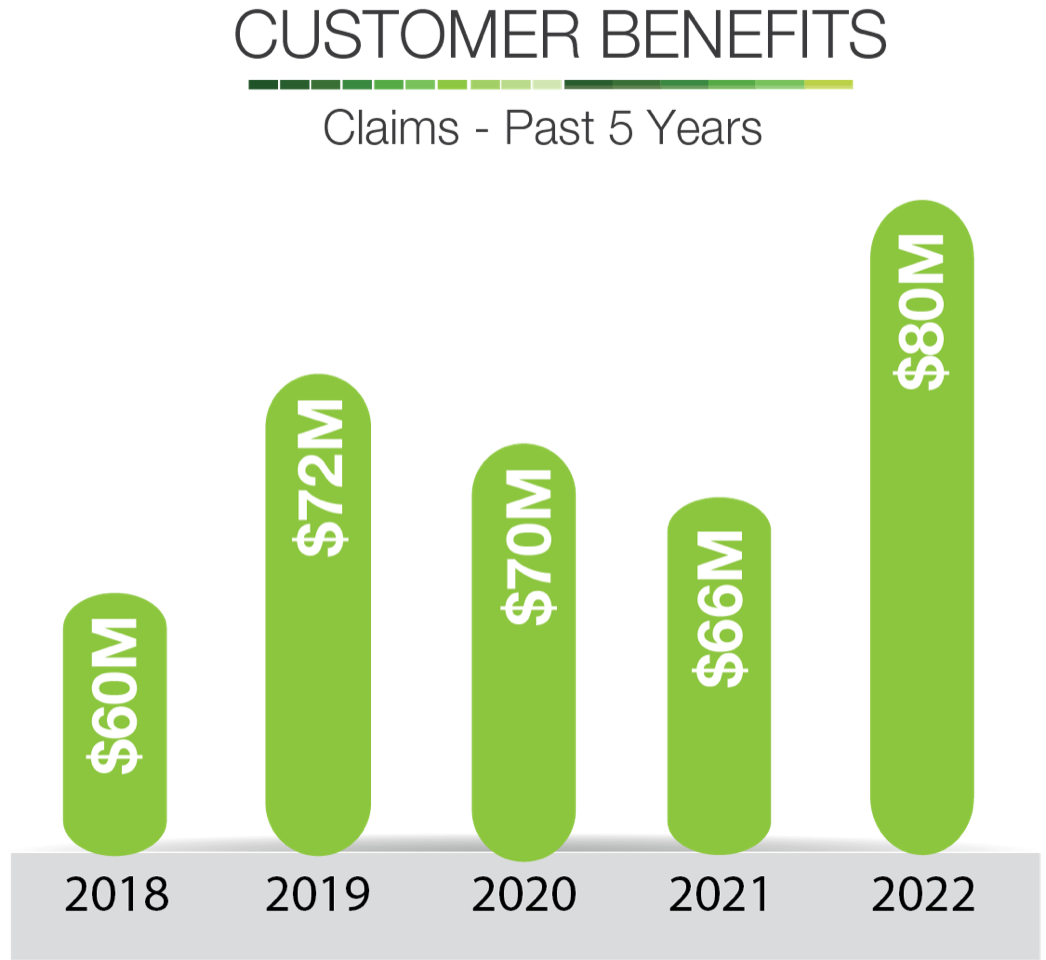

Over the last five years, BSP Life has paid over $350 million in customer benefits.

Mr Nacola also highlighted some worrying trends. “Our data over the last five years indicate the onset of chronic ailments and deaths at younger ages, correlating with the rise of NCDs which claims 80% of deaths in Fiji. The highest number of medical claims from 2017 to 2022 was in the 30 – 39 year age bracket. For death claims, the highest number was in the 40 – 54 age bracket. These statistics remind us of the need to take physical and mental wellness seriously and reinforces the need for Life and Health insurance.”

BSP Life’s ability to make large payouts year on year is underpinned by its strong and diversified investment portfolio which now stands at $985 million.

BSP Life has 10 Customer Service Centres around Fiji, a customer portal on its website www.bsplife.com.fj and a 24/7 Emergency Helpline.